CFO

Services

We Focus On Your Books So You Can Focus On Your Business

CFO Services

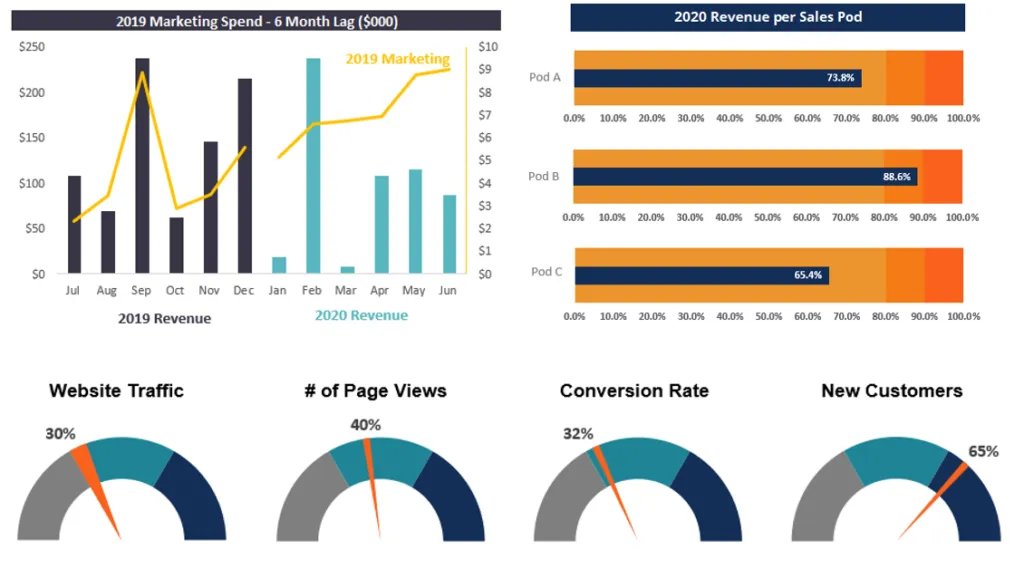

We take the financial data from your Balance Sheet and Income Statement, and through financial analysis, forecasting and dashboarding, we can:

Identify key trends - either positive or negative - that are affecting your business.

Compare actual monthly results to budgeted projections to determine - in real time - if course corrections are needed.

Forecast cash, both short-term and long-term, providing you the ability to make investing decisions in current months, with the knowledge of what cash will be in future months

Historical Analysis

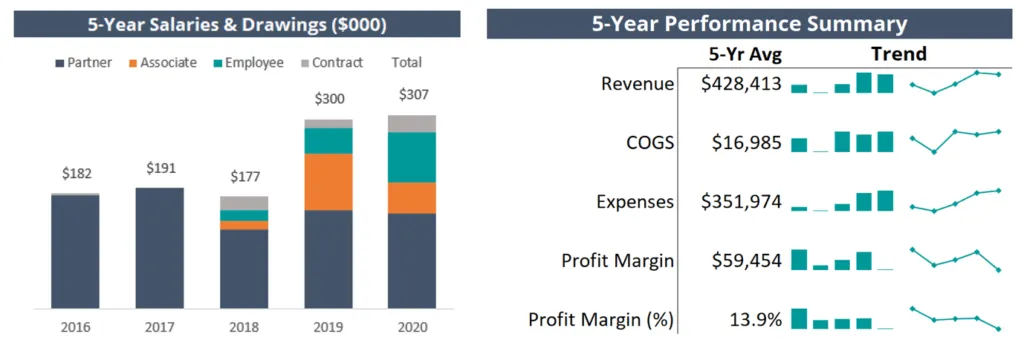

The first step is a deep dive into the historical financial data of your business. This often identifies key pieces of information, or trends, that are illuminating when put into a visual format.

The client above enlisted the services of a business coach in 2018. He took a reduction in wages to pay for the coaching. In the following two years, you can see the business did grow substantially. However, the partner's wages were still considerably LOWER than before the growth, and his profit margin had DECREASED.

We proposed a course correction that immediately provided a $50K increase in wages to the partner, with no change to other staffing or salaries, and put a plan in place to address profit moving forward

Budgeting

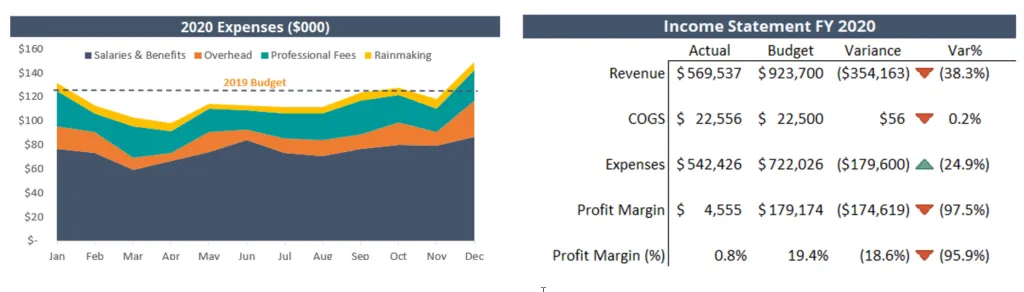

If your company does not have a current budget, we will create a proposed budget for you, based on historical spending, and then work with you to make adjustments to fit your future spending plans.

Once we have a finalized budget in place, we can provide Budget-to-Actual Reports, as well as dashboard components that illustrate how company performance is meeting, or falling short, of projections.

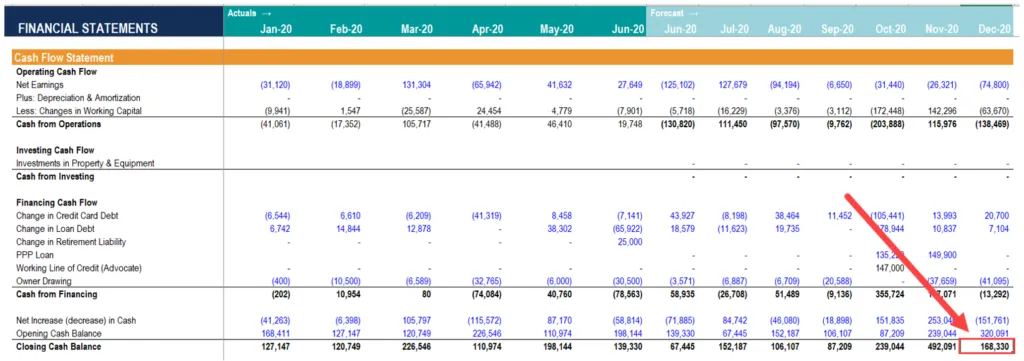

Forecasting

12-Month Cash Flow Forecast

Based on a compilation of both your historical data and budgeting projections, we can then forecast cash flows. This is especially useful to plan for future spending, such as marketing campaigns, tax payments and year-end bonuses or owner draws.

Weekly Cash Forecast Planner

If your firm is looking for help maneuvering through a tight cash season, whether you're a start-up with limited funds, or had an unexpected loss of a high-revenue client, we have a Weekly Cash Planner to help map out the expected revenue and spending on a week-to-week basis.

The weekly planner is a collaboration between you and the controller, and is updated with actuals and projections each week. This planner also provides a "What If" scenario section, where you can see how a bank loan, or sale of an asset, for example, would impact the bottom-line cash number.

Ad Hoc Reporting

Because Centricity Accounting customizes all our reports specifically to your business, we are uniquely able to accommodate ad hoc reporting needs in a way others cannot.

Whether it's a one-time historical comparison, a request to pinpoint a spend-to-revenue correlation, or a desire to see key data visualized, we can custom build whatever you need, as either a stand-alone report, or as an additional tab in your dashboard workbook.